If you own a business or rental property, you may be wondering how long you can depreciate your landscaping. Depreciation is a tax deduction that allows you to recover the cost of an asset over time. Landscaping is considered a land improvement and can be depreciated over a certain period of time, depending on the useful life of the asset.

Understanding depreciation is important because it can help you save money on your taxes. Depreciation allows you to deduct the cost of an asset over its useful life, which can help lower your taxable income. Landscaping is considered a depreciable asset, meaning you can deduct the cost of the asset over a period of time. However, the useful life of landscaping can vary depending on the type of asset and how it is used.

Key Takeaways

- Landscaping is considered a depreciable asset and can be deducted over its useful life.

- The useful life of landscaping can vary depending on the type of asset and how it is used.

- Proper record-keeping and reporting are essential for claiming depreciation deductions.

Understanding Depreciation

https://www.youtube.com/watch?v=UDV6j51MrTc&embed=true

As a rental property owner, you are allowed to claim a tax deduction for the depreciation of your property. Depreciation is a tax deduction that allows you to recover the cost of an asset over time. In other words, it is a way to spread out the cost of an asset over several years instead of deducting the entire cost in the year you purchased it.

Basics of Depreciation

Depreciation is the process of allocating the cost of an asset over its useful life. The IRS has established guidelines for determining the useful life of different types of assets. The useful life is the length of time over which the asset is expected to be useful to the business.

Depreciation Methods

There are two primary methods of depreciation: the General Depreciation System (GDS) and the Alternative Depreciation System (ADS). The GDS is the most commonly used method of depreciation and is used for most assets. The ADS is used for assets that have a longer recovery period than the GDS or for assets that are used predominantly outside of the United States.

The Modified Accelerated Cost Recovery System (MACRS) is the method used to calculate depreciation under the GDS. MACRS assigns a recovery period to each asset based on its useful life. The recovery period is the number of years over which the asset can be depreciated.

In conclusion, understanding depreciation is essential for rental property owners. Depreciation is a tax deduction that allows you to recover the cost of an asset over time. There are two primary methods of depreciation: the General Depreciation System (GDS) and the Alternative Depreciation System (ADS). The Modified Accelerated Cost Recovery System (MACRS) is the method used to calculate depreciation under the GDS.

Landscaping and Depreciable Assets

https://www.youtube.com/watch?v=lkOsbKKS7mk&embed=true

When it comes to owning a rental property, you may have invested in landscaping to enhance its curb appeal. Landscaping costs are considered a land improvement and are not capitalized to the cost of land. Land improvements are capitalizable, but they are depreciated over their useful life.

Landscaping as a Depreciable Asset

Landscaping is a depreciable asset, meaning that its value decreases over time. To calculate depreciation for landscaping on a rental property, you’ll need to determine the useful life of the asset and its purchase price. You can then multiply the purchase price by a specified rate based on the useful life of the asset.

Differentiating Land from Land Improvements

It’s important to differentiate between land and land improvements. Land costs can be capitalized but land is not depreciated. Land preparation costs, such as landscaping costs, incurred in preparing land for business use can be depreciated.

When it comes to determining the useful life of a depreciable asset, the IRS provides guidelines for various types of assets. For example, the useful life of landscaping is typically 15 years. However, it’s important to note that the useful life of an asset can be adjusted if it is determined that the asset will last longer or shorter than originally estimated.

In conclusion, landscaping is a depreciable asset that can be deducted from your rental property income over its useful life. When it comes to determining the useful life of landscaping, it’s important to follow IRS guidelines and differentiate between land and land improvements.

Depreciation of Landscaping for Rental Properties

https://www.youtube.com/watch?v=Eng3r5sj22s&embed=true

If you own a rental property, you may be wondering how to depreciate the cost of landscaping. Depreciation is a tax deduction that allows you to recover the cost of an asset over time. Landscaping is considered a capital improvement to your rental property and can be depreciated over a period of 27.5 years for residential rental property, according to the IRS Publication 527.

Rental Property Depreciation

Depreciation is an important tax deduction for rental property owners. It allows you to deduct the cost of the property over a period of time, which reduces your taxable income. The IRS considers rental property to be a capital asset, which means it can be depreciated over a period of time. The depreciation period for residential rental property is 27.5 years.

« Is Landscaping Hard to Learn? Tips for Beginners How Long Is Landscaping Season: A Quick Guide »

Calculating Depreciation for Landscaping

To calculate the depreciation for landscaping on a rental property, you need to determine the useful life of the asset and its purchase price. You can then multiply the purchase price by a specified rate based on the useful life of the asset. For example, if you purchased landscaping for $5,000 with a 27.5-year useful life, you’d multiply $5,000 by 1/27.5, which equals a depreciation deduction of $181.82 per year.

It’s important to note that not all landscaping costs can be depreciated. The costs of clearing, grading, planting, and landscaping are usually all part of the cost of land and can’t be depreciated. However, you may be able to depreciate certain land preparation costs if the costs are so closely associated with other depreciable property that they can be considered part of the depreciable cost.

In conclusion, if you own a rental property, you can depreciate the cost of landscaping over a period of 27.5 years. To calculate the depreciation, you need to determine the useful life of the asset and its purchase price. Not all landscaping costs can be depreciated, so it’s important to consult with a tax professional to ensure you’re taking advantage of all available deductions.

IRS Guidelines and Useful Life

Useful Life of Landscaping

Landscaping is an important aspect of any property, whether it’s a commercial or residential property. It enhances the aesthetics and value of the property. However, like any other asset, landscaping also has a limited lifespan. The IRS defines the useful life of landscaping as 15 years. This means that you can depreciate the cost of landscaping over a period of 15 years.

IRS Publication 946

The IRS provides guidelines for determining the useful life of assets, including landscaping. According to IRS Publication 946, the useful life of landscaping is 15 years. This means that you can claim a deduction for the cost of your landscaping over a period of 15 years.

The recovery period for landscaping is 15 years, which means that you can recover the cost of your landscaping over a period of 15 years. You can use the Modified Accelerated Cost Recovery System (MACRS) to determine the depreciation deduction for your landscaping.

It’s important to note that the useful life of landscaping may vary depending on several factors such as the type of landscaping, climate, and maintenance. For instance, if you have a large lawn that requires regular maintenance, it may have a shorter useful life compared to a small garden with low maintenance requirements.

In conclusion, the IRS guidelines state that the useful life of landscaping is 15 years. You can depreciate the cost of your landscaping over a period of 15 years using MACRS. However, the useful life of landscaping may vary depending on several factors such as the type of landscaping, climate, and maintenance.

Tax Implications and Deductions

https://www.youtube.com/watch?v=UyoFu2G1z9Y&embed=true

If you own a rental property, you may be eligible for tax deductions for landscaping expenses. Landscaping is considered a capital improvement, and you can depreciate the cost of landscaping over a period of time. This means that you can deduct a portion of the cost of landscaping each year from your rental income.

Deductions for Landscaping

To calculate your deductions for landscaping, you’ll need to determine the useful life of the asset and its purchase price. You can then multiply the purchase price by a specified rate based on the useful life of the asset. For example, if you purchased landscaping for $5,000 with a 39-year useful life, you’d multiply the purchase price by a rate of 2.5641% to get a deduction of $128.21 per year.

Landscaping expenses that are considered maintenance or repair rather than capital improvements may be deductible as business expenses. For example, if you hire a landscaper to mow the lawn or trim the hedges, you can deduct the cost of those services as a business expense.

Section 179 and Bonus Depreciation

Section 179 of the tax code allows businesses to deduct the full cost of qualifying property in the year it is purchased, rather than depreciating it over a number of years. Landscaping may qualify for the Section 179 deduction if it is considered “qualified improvement property,” which includes improvements to the interior of nonresidential real property.

Bonus depreciation allows businesses to take an additional deduction on top of the Section 179 deduction. Bonus depreciation applies to new property, including landscaping, that is placed in service after September 27, 2017, and before January 1, 2024. The bonus depreciation rate is 100% for property placed in service before January 1, 2023, and gradually decreases over the following years.

In conclusion, landscaping can provide tax benefits for rental property owners through depreciation deductions and business expense deductions. You may also be able to take advantage of the Section 179 deduction and bonus depreciation for landscaping that qualifies. Be sure to consult with a tax professional to determine the best strategy for maximizing your deductions and profits.

Record-Keeping and Reporting

https://www.youtube.com/watch?v=roKEftDyBVA&embed=true

Keeping track of your landscaping expenses and properly reporting them is crucial for accurately calculating and claiming depreciation. By documenting your expenses and filing Form 4562, you can ensure that you are taking advantage of all available tax deductions while also staying compliant with IRS regulations.

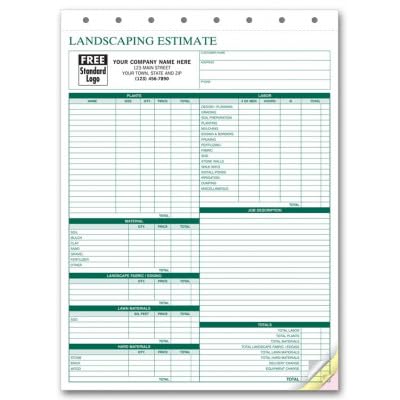

Documenting Landscaping Expenses

To accurately calculate depreciation for your landscaping, you need to keep detailed records of all expenses related to the property. This includes the cost of any plants, trees, or other landscaping features, as well as any expenses related to installation or maintenance. Keep receipts, invoices, and other documentation to prove the cost basis of your landscaping.

It is important to note that not all landscaping expenses are eligible for depreciation. Routine maintenance and repairs are not considered capital expenses and cannot be depreciated. However, if you make improvements to your landscaping that increase the value of the property or extend its useful life, these expenses can be depreciated.

Filing Form 4562 for Depreciation

To claim depreciation for your landscaping, you will need to file Form 4562 with your tax return. This form is used to report depreciation and amortization, as well as to claim the Section 179 deduction for certain property.

When filling out Form 4562, you will need to provide detailed information about the property being depreciated, including the date it was placed in service, its cost basis, and the depreciation method being used. You will also need to provide information about any Section 179 deductions you are claiming.

If you are unsure about how to properly document your landscaping expenses or file Form 4562, it is recommended that you consult with an accountant or tax professional. They can help ensure that you are accurately calculating and claiming depreciation, while also staying compliant with IRS regulations.

Frequently Asked Questions

What is the depreciable life of land improvements according to the IRS?

According to the IRS guidelines for depreciation on residential rental properties, all non-structure assets such as landscaping are considered “land improvements” and can have up to a 39-year depreciation period depending on the type of asset. [1]

Can landscaping costs be considered a capital improvement for tax purposes?

Yes, landscaping costs can be considered a capital improvement for tax purposes. The cost of capital improvements, including landscaping, can be added to the basis of the property and depreciated over the asset’s useful life. [2]

Should landscaping be capitalized or expensed when doing accounting for a property?

Landscaping should be capitalized and added to the cost basis of the property. This allows the cost of the landscaping to be depreciated over its useful life, which can provide a tax benefit to the property owner. [1]

Are land improvements, like landscaping, eligible as qualified improvement property?

Yes, land improvements, like landscaping, can be eligible as qualified improvement property. Qualified improvement property refers to improvements made to the interior of nonresidential buildings, including land improvements, that are placed in service after December 31, 2017. [2]

How do you determine the depreciation life for leasehold improvements, including landscaping?

The depreciation life for leasehold improvements, including landscaping, is determined by the IRS guidelines for depreciation on residential rental properties. All non-structure assets such as landscaping are considered “land improvements” and can have up to a 39-year depreciation period depending on the type of asset. [1]

What are the current depreciation rules for capital improvements such as landscaping?

The current depreciation rules for capital improvements such as landscaping allow the cost of the improvement to be depreciated over its useful life. Land improvements, like landscaping, can have up to a 39-year depreciation period depending on the type of asset. [1]

[1] How to Depreciate Landscaping for Rental Property in 2023

[2] Topic No. 704, Depreciation | Internal Revenue Service